what is an open end equity lease

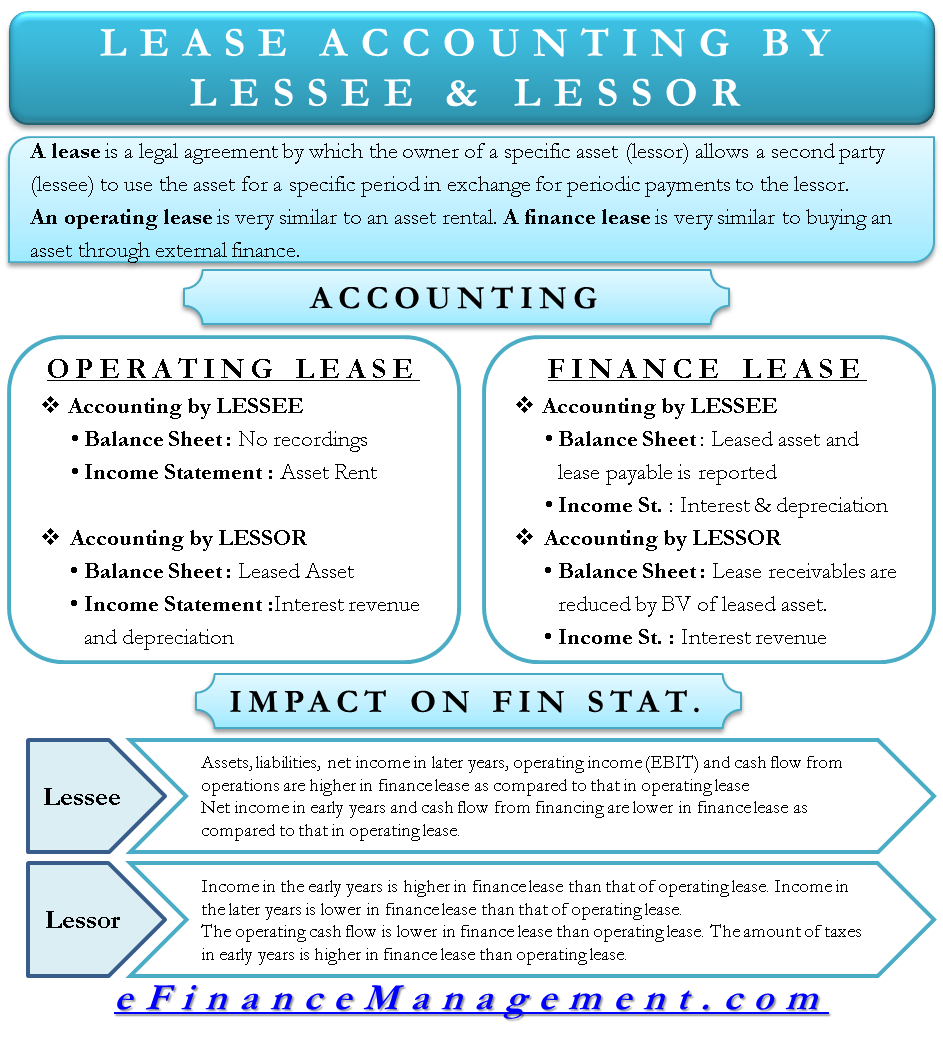

Read more at the end of the lease period. The two most common types of leases in accounting are operating and financing capital leases.

Open Vs Closed End Leases What To Know Credit Karma

An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing.

. An open-end lease containing a 12-month term that then goes month-to-month would require 12 months of payments on the balance sheet. However it is possible in some cases and we can explain how this can happen. It is hard to say if the positive equity will increase after the extra time provided to you.

If you arent in a negative equity situation with your lease meaning that the amount you owe your leasing bank for the cars total value is less than your insurance payoff you wont receive any of your leasing payments back. Understanding Lease Equity. In most open-end leases you are also.

An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk. Re-leasing the vehicle will extend the payments for a few months. Bargain purchase option-Lessee can buy an asset at the end of term at a value below market price.

This works well for employers since the cost of the vehicles can be written-off or. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began.

The open-end lease bill breaks down the monthly depreciation management fee interest and taxes. The outstanding balance will decrease and the vehicle will continue to depreciate. Monthly payment amounts vary usually stepping down year-over-year as the asset is amortized.

At end of term the final accounting will show a loss or gain reconditioning and transportation charges and a disposition fee. However in an open-end lease you would be able to receive a check from the owner for the difference. Your down payment amount and any monthly payments you made toward your lease belong to the bank.

When you lease a car you dont own it unless you buy it at the end of the term. Open-end TRAC leases enable fleet. Open-end leases also exist and are most often used in the case of commercial business lending.

Present value-The present value of the lease payment is 90 of the fair value of the asset at the beginning. In the closed-end lease you usually never know what the rate is charged to the lessor or what method of funding is used by the lessors funding source. TRAC is an acronym for terminal rental adjustment clause However the basic principles of the TRAC lease sometimes are misunderstood.

There are no mileage restrictions or penalties and the vehicle s can be. The employer takes all the financial risk. The open-end finance lease allows this flexibility while the closed-end lease does not.

It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule. The terms include a minimum 12-month lease technically 367 days followed by a month-to-month structure.

A closed-end lease that is typically written for a contractual term of two to three years would require a larger amount on the balance sheet assuming the fleet does not believe there is an obligation to take on. Lease term-Lease term comprises at least 75 of the useful life of the asset. Leases are contracts in which the propertyasset owner allows another party to use the propertyasset in exchange for money or other assets.

A basic tenet of accounting is matching expense to the time period in which it occurs. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement amounting to the difference between the residual and fair market value of the asset. This happens when the lessee drives less than the mileage allotted.

Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease. A companyemployer will assume management and leasing of the car to its employees not the leasing company. The open-end TRAC lease has been a staple in the fleet industry for decades.

Advantages disadvantages and examples. Open-end leases have flexible structures that are as close to vehicle ownership as possible only with the additional benefits of leasing. In a closed-end lease the lessor takes on the depreciation risk but the terms are more.

Closed-end leases are based on the idea that the distance you drive annually is fairly predictable typically 12000 miles annually. Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare. What is an open-end lease.

In this age of financial sophistication numerous indices are available to set interest rates. Often open-end leases are used in commercial transactions.

What Is The Difference Between An Open Vs Closed Lease

What Is The Difference Between An Open Vs Closed Lease

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

What Is The Difference Between An Open Vs Closed Lease

Advantages And Disadvantages Of Capital Lease Accounting And Finance Financial Management Economics Lessons

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

![]()

Car Leasing Guide Everything You Need To Know Kelley Blue Book

Printable Rent To Own Contract How To Draft A Rent To Own Contract Download This Printable Rent To Contract Template Purchase Agreement Real Estate Contract